Menu

Strategic Blueprint

2015-2020

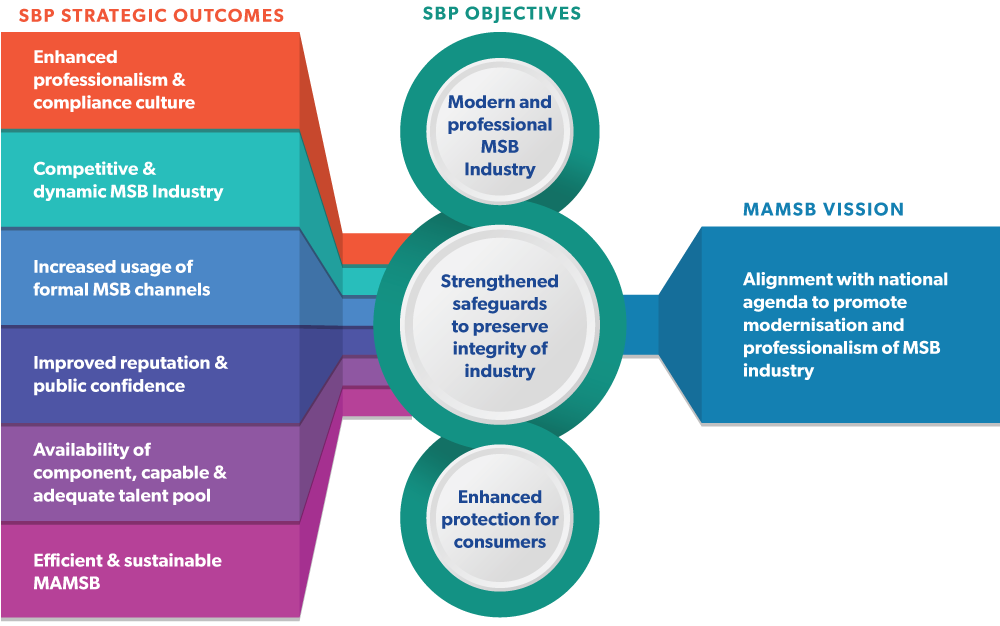

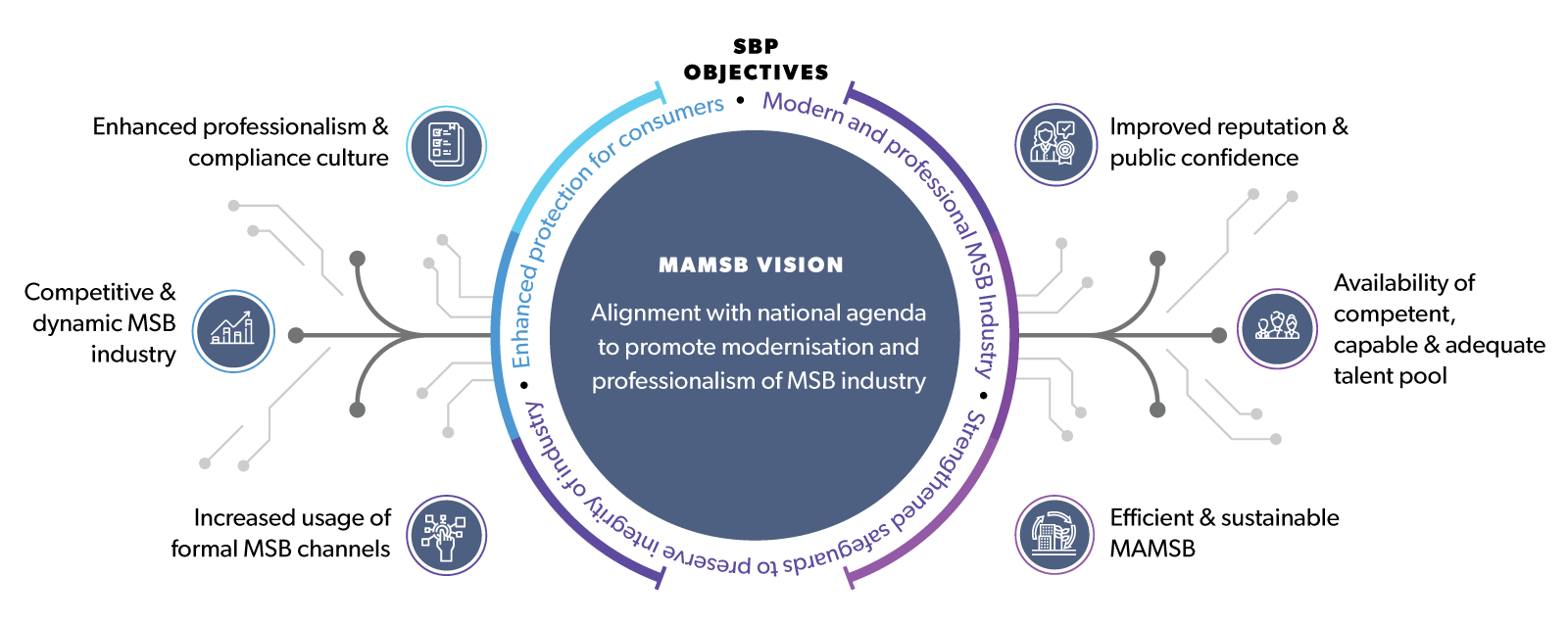

The Association’s efforts to transform and modernize the MSB industry are guided by the MAMSB Strategic Blueprint (“SBP”) for Money Services Business Industry 2015 – 2020. The linkage between the Association’s vision and the SBP’s objectives and outcomes are depicted by Table 1.

The SBP was crafted to enable MAMSB to focus on strategic outcomes that will contribute positively towards achieving its vision and playing its role to accomplish the objectives of its existence.

In 2019, the MAMSB Secretariat together with the support of Members continued to ensure initiatives under the SBP are implemented as envisioned.

The broad initiatives under the SBP can be read on Page 8 of the Annual Report 2020.

The Taskforce on the Money Services Business Strategic Blueprint was set up by the Association in January 2021 pursuant to the Money Services Business Regulator’s (MSBR) aspiration for the Association to continue its efforts to modernise and transform the MSB industry into a progressive and professional sector for the next 5 years (2022-2026). The inaugural strategic blueprint (SBP) that was crafted in 2015 had successfully identified the 3-fold objectives for the development of the SBP and derived 6 SBP Strategic Outcomes that collectively aimed at meeting the Association’s Vision.

The Taskforce in principle has agreed to maintain the 6 SBP Strategic Outcomes and will make minor changes for better sustainability whilst maintaining a competitive and dynamic MSB industry. The new MSB Strategic Blueprint 2022-2026 (New SBP) will actionplans to meet the current MSB landscape that has moved into thedigital and fintech space.

The present Taskforce consisting of our 9 esteemed members; representing money changers, remitters, e-money service providers and fintech players are in the process of developing the new Strategic Blueprint. They have split into 3 small groups to brainstorm on 2 Strategic Outcomes each to enable the development of new action plans.

List of Members Contributing under the Task Force

Strategic Outcome 1: Enhanced Professionalism & Compliance Culture

Strategic Outcome 2: Availability Of Competent, Capable & Adequate Talent Pool

Group One

Lead by Mr. Mohamed Ershad

(S.S.B Interchange Sdn Bhd)

Ms. Leow Su Lin

(FOO In Sdn Bhd)

Mr. Ramesh Chaulagain

(IME Sdn Bhd)

Strategic Outcome 3: Competitive, Dynamic & Competitive MSB Industry

Strategic Outcome 4: Efficient & Sustainable MAMSB

Group Two

Lead by Mr. Manimakudam Karuppiah

(Suria Muhabat Sdn Bhd)

Mr. Sarveswaran Raja Gopal

(TNG Digital Remittance Sdn Bhd)

Mr. Akbar Batcha bin Mohamed Shamsuddin

(Akbar Money Changer Sdn Bhd)

Strategic Outcome 5: Increased Usage Of Formal MSB Channels

Strategic Outcome 6: Improve Reputation & Public Confidence

Group Three

Lead by Mr. Adrian Yap

(MoneyMatch Sdn Bhd)

Ms. Noorzliana Binti Ahmad

(Merchantrade Asia Sdn Bhd)

Rajendar Dhorkay

(NIUM Sdn Bhd)