MAMSB will be organising the AGM 2022 on 30 April...

Read More

Menu

Resources

MPA Framework

News/ Media

MAMSB New Office

Please be informed that MAMSB has moved to the new...

Read MorePublication

> Digital Newsletter

> MAMSB Annual Report

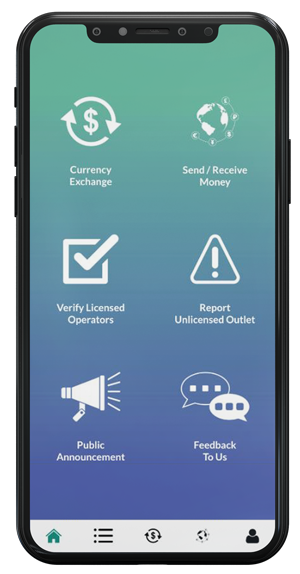

MSB Advisor App

In our effort to create a single point of reference for everything MSB, we worked on ensuring the app appeals to consumers out there from every segment.

FAQ

> Membership

The application form to register a licensee as MAMSB member can be downloaded here Membership Application Form Link

A licensee or an approved money services business agent applying for membership must submit the completed Membership Application Form as prescribed by the Council and other required documents to MAMSB Membership department via email at manager@mamsb.org.my (Ms Brindha, Membership Division).

There are two types of fees payable by a member or an associate: Entrance Fee and Annual Subscription Fee. Entrance Fee will be charged as subscription fee. Annual subscription fee for members is RM500.00 and for associates is RM250.00. This is payable on an annual basis within the first three (3) month of the year. Click here to view the membership admission and renewal fees.

Members are required to renew their annual subscriptions online via the MAMSB Member Portal.

You can pay your annual membership subscription fees online using your debit/credit card (Master/Visa) or via online banking (personal/corporate account) through the MAMSB Member Portal via SenangPay.

Reminders will be sent to your company member representative to encourage payment of the fee and if fail, we will notify Bank Negara on the outstanding of your membership fee as required under clause 6.8 in the constitution for BNM’s further action.

Membership certificate will be sent within 2 weeks upon completion of renewal process via courier service.

Click ‘forget password’ and you will receive the new reset password notification via the email. Login to the portal using the new password.

A Member may cancel the membership by sending a notice in writing to the MAMSB Membership department via email at manager@mamsb.org.my (Ms Brindha, Membership Division) and upon acceptance by the Council, the company shall cease to be a Member and his/her name shall be removed from the Register of Members.

Yes. Member must renew your membership to enjoy the member rate of MAMSB’s trainings and events.

> Training

The program comprises four (4) modules which will be conducted via workshop attendance and assessment. The components of the program are:

- Module 1: AML/CTF – Understanding the AML/CFT Framework

- Module 2: Customer Due Diligence Process

- Module 3: Managing Suspicious Transactions

- Module 4: Understanding & Application of Risk Based Approach (RBA)

To be fully certified, it is necessary to successfully complete all four modules in its order, from Module 1 to Module 4. As, BNM has made it compulsory for all Head Of Compliance registered with BNM to be certified by 2016, undergoing this complete program is extremely important.

A new fee structure for 2022 has been approved and the list of fee can be found here.

Yes, BNM has approved the modal of attending any Module any time as long you complete all 4 modules. A certain fee structure applies to different level of Module.

Any new CO must complete GOCO Module within 2 years of employment. This is a mandatory requirement.

Yes, they can attend and will receive certification of completion which will be an added value for them as a front desk/ teller.

Due to the pandemic, Module 1 and Module 2 trainings are done virtually but exams remain face to face and the Secretariat will advise participants when to attend based on your region. In March 2022, the Secretariat will be mobilising Module 1 and Module 2 exams online. We will keep you posted.

For Module 3 and Module 4, exams remain face to face after each training session.

Module 1 and Module 2 remain virtually so everyone from every region can attend.

Module 3 and Module 4 will be held face to face once every quarter and depending on the respond and volume of participants in each region.

Upon completion of all 4 modules, CO can proceed to sit for Accreditation programmes. You can view here to make your choice.

You can fill up the form online and submit electronically to MAMSB. Click here and select New Registration to proceed forward.

Yes you have to write to fied@bnm.gov.my to inform on the new CO.

The appointment of a competent and capable Compliance Officer by a licensee is critical in ensuring proper compliance with the AML/CFT requirements in carrying out the money services business activities. The Bank expects the appointed Compliance Officer of a licensee to be able to demonstrate the following in the course of discharging his/her duties.

Please read the policy document from BNM.

You can download the Policies from these links:

- Anti-Money Laundering, Countering Financing of Terrorism and Targeted Financial Sanctions for Financial Institutions (AML/CFT and TFS for FIs)(New – 3 May 2021) https://amlcft.bnm.gov.my/publication/AML_CFT_TFS_PD.pdf

- APPENDIX 3: Compliance Officer Nomination Notification Form (New – 3 May 2021) https://amlcft.bnm.gov.my/document/DNFBP/form/DNFBP_3_Borang_Pemberitahuan_CO.pdf

- APPENDIX 4: Customer Due Diligence Form https://amlcft.bnm.gov.my/document/DNFBP/form/DNFBP_4_CDD_BM.pdf