Menu

The Association

About Us

Malaysian Association of Money Services Business or MAMSB (Persatuan Perniagaan Perkhidmatan Wang Malaysia) was registered on 22nd August 2013 with the Registrar of Societies under the Societies Act 1966. MAMSB is the national association for licensees under the Money Services Business Act 2011 (MSBA) as well as those enterprises that have been approved as money services business agents to principal licensees under the MSBA. MAMSB is dedicated to advancing the money services business industry in Malaysia. Its ultimate aim is to ensure alignment with the national agenda to promote modernisation and professionalism of the money services business industry while representing the interest of members.

MAMSB Trajectory

Since 2013

Vision

To be a respectable organisation and driving force to modernise and enhance professionalism of the money services business industry in Malaysia.

> Mission & Objective

Click on image to enlarge

Fifth Term Leadership

> Council Members (2023/2026)

President

DATO’ SRI JAJAKHAN

BIN KADER GANI

Chief Executive Officer

Jags Money Sdn Bhd

Jags Money Sdn Bhd

View Profile

President

DATO’ SRI JAJAKHAN

BIN KADER GANI

Chief Executive Officer

Jags Money Sdn Bhd

Jags Money Sdn Bhd

Dato’ Sri Jajakhan is the Chief Executive Officer of Jags Money Sdn. Bhd. and was elected as the President of the Malaysian Association of Money Service Business (“MAMSB”) in September 2020.

He has more than 17 years experience in the financial services industry, having started his career as a remisier with OSK Securities in 2003, before taking the bold step to venture into the world of money changing, and founded Vital Rate Sdn. Bhd. in 2005. As the Chief Executive Officer, he spearheaded marketing, technology, business development and establishment of business collaborations and alliances to expand into remittances as an Agent to drive reveneue growth. Vital Rate soon emerged as a key player in money changing with the opening of branches in the tie-one shopping malls of Pavilion, KLCC and KL Sentral. In 2017, Vital Rate was acquired by Merchantrade Asia Sdn. Bhd.

In 2018, Jajakhan was appointed as the CEO and director of Jadeline Exchange Sdn Bhd. Jadeline is building scale with a business strategy of mergers and acquisitions, digitalization of operations and enhancing customer experience. In August 2021, Jadeline Exchange merged to Jags Money Sdn Bhd and obtained Class A license to operate in the MSB industry.

Jajakhan has played an active role in the transformation of the money exchange industry, from inception of MAMSB in January 2014, as the Class C Council Member of MAMSB from 2014 – 2016, and later as its Vice-President from 2016 – 2017.

Vice President

THAMEEJUDEEN BIN MOHD IBRAHIM

Chief Executive Officer

Al-Tamij Capital Resources Sdn Bhd

Al-Tamij Capital Resources Sdn Bhd

View Profile

Vice President

THAMEEJUDEEN MOHD IBRAHIM

Chief Executive Officer

Al-Tamij Capital Resources Sdn Bhd

Al-Tamij Capital Resources Sdn Bhd

COMING SOON

Secretary

MOHAMED ERSHAD BIN SYED JAHABAR

Chief Executive Officer

S.S.B Interchange Sdn Bhd

S.S.B Interchange Sdn Bhd

View Profile

Secretary

MOHAMED ERSHAD BIN SYED JAHABAR

Chief Executive Officer

S.S.B Interchange Sdn Bhd

S.S.B Interchange Sdn Bhd

COMING SOON

Treasurer

MANIMAKUDOM KARUPPIAH

Chief Executive Officer

Suria Muhabat Sdn Bhd

Suria Muhabat Sdn Bhd

View Profile

Treasurer

MANIMAKUDOM KARUPPIAH

Chief Executive Officer

Suria Muhabat Sdn Bhd

Suria Muhabat Sdn Bhd

Mani joined Suria Muhabat Sdn Bhd in June 2016 as the CEO and subsequently has become one of the shareholders of the company. He has extensive knowledge in treasury dealing and risk advisory solutions, banking, portfolio investment, financial management, and money services business ranging more than 29 years of working experience in MSB, central banking, investment banking and commercial banking environments.

Prior to joining Suria Muhabat Sdn Bhd, Mani’s last posting was as the Deputy Director at the Treasury Department at Bank Negara Malaysia, managing the investment portfolio and the currency composition of the International Reserves from Mar 2013 to Feb 2016. Previously, he held the position of Director, Head of Treasury at KAF Investment Bank Bhd. (Mar 2008 – Feb 2013) and various positions at Maybank ( Senior Treasury Dealer/ Dealer : Jul 1997 to Feb 2008; Branch Operations Officer: Jul 1994 – Jun 1996).

He holds a postgraduate degree in MBA Finance from The University of Nottingham and a BBA (Hons.) degree from the National University of Malaysia (UKM). He had also completed and passed the Financial Market Association Malaysia Certification in 1997 and the AML/CFT Compliance program for MSB Industry in 2017.

Head of Class A

ESPEN KRISTENSEN

Chief Executive Officer

IME (M) Sdn Bhd

IME (M) Sdn Bhd

View Profile

Head of Class A

ESPEN KRISTENSEN

Chief Executive Officer

IME (M) Sdn Bhd

IME (M) Sdn Bhd

Mr. Espen Kristensen Aged 50, a graduate in Master of Law (LLM) from Bond University, Australia has more than 15 years ’experience in international remittance, working with major players like Western Union and Euronet Worldwide. Mr Kristensen is currently Class A Council Member and Chairman of MAMSB Legal Committee.

His expertise is from Operations, Business Development and Digital. Solid experience from roll-out of European directive agent’s module in the European Union and geo expansion both in Europe and across APAC.

Mr Kristensen is currently the CEO of of IME (M) SDN BHD and he also has the role as Managing Director for Ria Money Transfer Asia Pacific. Ria money transfer is the 2nd largest global remittance company. Other specialties are Commercial Negotiations and Mediation, e-Commerce, e-money, Business Strategy and B2B.

Head of Class B

ONG HONG KHOON

Chief Executive Officer

Western Union Payments (Malaysia) Sdn Bhd

Western Union Payments (Malaysia) Sdn Bhd

View Profile

Head of Class B

ONG HONG KHOON

Chief Executive Officer

Western Union Payments (Malaysia) Sdn Bhd

Western Union Payments (Malaysia) Sdn Bhd

COMING SOON

Head of Class C

SEE YOKE SIEW

Chief Executive Officer

Adcrew Sdn Bhd

Adcrew Sdn Bhd

View Profile

Head of Class C

SEE YOKE SIEW

Chief Executive Officer

Adcrew Sdn Bhd

Adcrew Sdn Bhd

COMING SOON

Class D Council Representative

RAKESH A/L ARAVINDAN

Managing Director

Travelex Currency Exchange & Payment Sdn Bhd

Travelex Currency Exchange & Payment Sdn Bhd

View Profile

Class D Council Representative

RAKESH A/L ARAVINDAN

Managing Director

Travelex Currency Exchange & Payment Sdn Bhd

Travelex Currency Exchange & Payment Sdn Bhd

COMING SOON

Chairperson of East Malaysia Region

KELVIN LU ZEN KOCK

Chief Executive Officer

Million Serenity Sdn Bhd

Million Serenity Sdn Bhd

View Profile

Head of Class C

KELVIN LU ZEN KOCK

Chief Executive Officer

Million Serenity Sdn Bhd

Million Serenity Sdn Bhd

COMING SOON

Chairperson of Central Region

MOHAMMED FAIZHAL BIN AHAMED LEBBAI

Chief Executive Officer

Mohd Faizhal Group Sdn Bhd

Mohd Faizhal Group Sdn Bhd

View Profile

Head of Class C

SEE YOKE SIEW

Chief Executive Officer

Adcrew Sdn Bhd

Adcrew Sdn Bhd

COMING SOON

Chairperson of Southern Region

ANALISA YIN BINTI ABDULLAH

Chief Executive Officer

Akar Warisan Sdn Bhd

Akar Warisan Sdn Bhd

View Profile

Chairperson of Southern Region

ANALISA YIN BINTI ABDULLAH

Chief Executive Officer

Akar Warisan Sdn Bhd

Akar Warisan Sdn Bhd

Madam Analisa Yin Binti Abdullah is the Chief Executive Officer of Akar Warisan Sdn Bhd. She has been in the MSB industry as Money Changer since 2004 even before the inception of MSB formerly known as Akta Pengurup Wang 1998. Madam Analisa held the position of Compliance Officer from 2011-2017 and thereafter has been the CEO of Akar Warisan Sdn Bhd. In 2020, she was elected as the Chairman of Southern Region and a member of the MAMSB Council.

Madam Analisa is an active MAMSB member and hold the position as Chairman of Membership Committee, Vice Chairman of IT Committee and Member of Education Committee, Education Task force and 100 days KPI task force. Madam Analisa has graduated with O Levels, A Levels and Diploma in Marketing Studies.

Chairperson of Northern Region

MOHAMED SHERAFATH ALI BIN ABDUL RAHMAN

Managing Director

Sharafath Ali Sdn Bhd

Sharafath Ali Sdn Bhd

View Profile

Chairperson of Northern Region

MOHAMED SHERAFATH ALI BIN ABDUL RAHMAN

Managing Director

Sharafath Ali Sdn Bhd

Sharafath Ali Sdn Bhd

COMING SOON

East Coast Council Representative

AMARUL HANIF BIN HARUN

Managing Director

World Currency Sdn Bhd

World Currency Sdn Bhd

View Profile

East Coast Council Representative

AMARUL HANIF BIN HARUN

Managing Director

World Currency Sdn Bhd

World Currency Sdn Bhd

COMING SOON

Fifth Term Leadership

> Council Members (2023/2026)

President

DATO’ SRI JAJAKHAN

BIN KADER GANI

Chief Executive Officer

Jags Money Sdn Bhd

Jags Money Sdn Bhd

View Profile

President

DATO’ SRI JAJAKHAN

BIN KADER GANI

Chief Executive Officer

Jags Money Sdn Bhd

Jags Money Sdn Bhd

Dato’ Sri Jajakhan is the Chief Executive Officer of Jags Money Sdn. Bhd. and was elected as the President of the Malaysian Association of Money Service Business (“MAMSB”) in September 2020.

He has more than 17 years experience in the financial services industry, having started his career as a remisier with OSK Securities in 2003, before taking the bold step to venture into the world of money changing, and founded Vital Rate Sdn. Bhd. in 2005. As the Chief Executive Officer, he spearheaded marketing, technology, business development and establishment of business collaborations and alliances to expand into remittances as an Agent to drive reveneue growth. Vital Rate soon emerged as a key player in money changing with the opening of branches in the tie-one shopping malls of Pavilion, KLCC and KL Sentral. In 2017, Vital Rate was acquired by Merchantrade Asia Sdn. Bhd.

In 2018, Jajakhan was appointed as the CEO and director of Jadeline Exchange Sdn Bhd. Jadeline is building scale with a business strategy of mergers and acquisitions, digitalization of operations and enhancing customer experience. In August 2021, Jadeline Exchange merged to Jags Money Sdn Bhd and obtained Class A license to operate in the MSB industry.

Jajakhan has played an active role in the transformation of the money exchange industry, from inception of MAMSB in January 2014, as the Class C Council Member of MAMSB from 2014 – 2016, and later as its Vice-President from 2016 – 2017.

Vice President

THAMEEJUDEEN BIN MOHD IBRAHIM

Chief Executive Officer

Al-Tamij Capital Resources Sdn Bhd

Al-Tamij Capital Resources Sdn Bhd

View Profile

Vice President

THAMEEJUDEEN MOHD IBRAHIM

Chief Executive Officer

Al-Tamij Capital Resources Sdn Bhd

Al-Tamij Capital Resources Sdn Bhd

COMING SOON

Secretary

MOHAMED ERSHAD BIN SYED JAHABAR

Chief Executive Officer

S.S.B Interchange Sdn Bhd

S.S.B Interchange Sdn Bhd

View Profile

Secretary

MOHAMED ERSHAD BIN SYED JAHABAR

Chief Executive Officer

S.S.B Interchange Sdn Bhd

S.S.B Interchange Sdn Bhd

COMING SOON

Treasurer

MANIMAKUDOM KARUPPIAH

Chief Executive Officer

Suria Muhabat Sdn Bhd

Suria Muhabat Sdn Bhd

View Profile

Treasurer

MANIMAKUDOM KARUPPIAH

Chief Executive Officer

Suria Muhabat Sdn Bhd

Suria Muhabat Sdn Bhd

Mani joined Suria Muhabat Sdn Bhd in June 2016 as the CEO and subsequently has become one of the shareholders of the company. He has extensive knowledge in treasury dealing and risk advisory solutions, banking, portfolio investment, financial management, and money services business ranging more than 29 years of working experience in MSB, central banking, investment banking and commercial banking environments.

Prior to joining Suria Muhabat Sdn Bhd, Mani’s last posting was as the Deputy Director at the Treasury Department at Bank Negara Malaysia, managing the investment portfolio and the currency composition of the International Reserves from Mar 2013 to Feb 2016. Previously, he held the position of Director, Head of Treasury at KAF Investment Bank Bhd. (Mar 2008 – Feb 2013) and various positions at Maybank ( Senior Treasury Dealer/ Dealer : Jul 1997 to Feb 2008; Branch Operations Officer: Jul 1994 – Jun 1996).

He holds a postgraduate degree in MBA Finance from The University of Nottingham and a BBA (Hons.) degree from the National University of Malaysia (UKM). He had also completed and passed the Financial Market Association Malaysia Certification in 1997 and the AML/CFT Compliance program for MSB Industry in 2017.

Head of Class A

ESPEN KRISTENSEN

Chief Executive Officer

IME (M) Sdn Bhd

IME (M) Sdn Bhd

View Profile

Head of Class A

ESPEN KRISTENSEN

Chief Executive Officer

IME (M) Sdn Bhd

IME (M) Sdn Bhd

Mr. Espen Kristensen Aged 50, a graduate in Master of Law (LLM) from Bond University, Australia has more than 15 years ’experience in international remittance, working with major players like Western Union and Euronet Worldwide. Mr Kristensen is currently Class A Council Member and Chairman of MAMSB Legal Committee.

His expertise is from Operations, Business Development and Digital. Solid experience from roll-out of European directive agent’s module in the European Union and geo expansion both in Europe and across APAC.

Mr Kristensen is currently the CEO of of IME (M) SDN BHD and he also has the role as Managing Director for Ria Money Transfer Asia Pacific. Ria money transfer is the 2nd largest global remittance company. Other specialties are Commercial Negotiations and Mediation, e-Commerce, e-money, Business Strategy and B2B.

Head of Class B

ONG HONG KHOON

Chief Executive Officer

Western Union Payments (Malaysia) Sdn Bhd

Western Union Payments (Malaysia) Sdn Bhd

View Profile

Head of Class B

ONG HONG KHOON

Chief Executive Officer

Western Union Payments (Malaysia) Sdn Bhd

Western Union Payments (Malaysia) Sdn Bhd

COMING SOON

Head of Class C

SEE YOKE SIEW

Chief Executive Officer

Adcrew Sdn Bhd

Adcrew Sdn Bhd

View Profile

Head of Class C

SEE YOKE SIEW

Chief Executive Officer

Adcrew Sdn Bhd

Adcrew Sdn Bhd

COMING SOON

Class D Council Representative

RAKESH A/L ARAVINDAN

Training Director

Travelex Currency Exchange & Payment Sdn Bhd

Travelex Currency Exchange & Payment Sdn Bhd

View Profile

Head of Class D

CHONG HUI YEE

Chief Executive Officer

E-Globex Sdn Bhd

E-Globex Sdn Bhd

Ms Chong Hui Yee is the CEO of E-Globex Sdn Bhd, a Licensed Money Changing and Wholesale Currency Business in Malaysia. She has a Bachelor (Hons) of Management Studies graduate and has over 5 years of working experience in the MSB industry. Leveraging on her extensive experience across AML/CFT compliance and risk management, she continues to improve the operations of the company to drive business growth and sustainability.

Serving as the Class D Representative, her primary role is to bridge and facilitate the communication between the Council and the Class D members. She is responsible to bring forward any opinions, concerns and ideas from members, for the purpose of uplifting the business standard and ultimately promoting a more resilient and innovative MSB industry

Chairperson of East Malaysia Region

KELVIN LU ZEN KOCK

Chief Executive Officer

Million Serenity Sdn Bhd

Million Serenity Sdn Bhd

View Profile

Head of Class C

KELVIN LU ZEN KOCK

Chief Executive Officer

Million Serenity Sdn Bhd

Million Serenity Sdn Bhd

COMING SOON

Chairperson of Central Region

MOHAMMED FAIZHAL BIN AHAMED LEBBAI

Chief Executive Officer

Mohd Faizhal Group Sdn Bhd

Mohd Faizhal Group Sdn Bhd

View Profile

Head of Class C

SEE YOKE SIEW

Chief Executive Officer

Adcrew Sdn Bhd

Adcrew Sdn Bhd

COMING SOON

Chairperson of Southern Region

ANALISA YIN BINTI ABDULLAH

Chief Executive Officer

Akar Warisan Sdn Bhd

Akar Warisan Sdn Bhd

View Profile

Chairperson of Southern Region

ANALISA YIN BINTI ABDULLAH

Chief Executive Officer

Akar Warisan Sdn Bhd

Akar Warisan Sdn Bhd

Madam Analisa Yin Binti Abdullah is the Chief Executive Officer of Akar Warisan Sdn Bhd. She has been in the MSB industry as Money Changer since 2004 even before the inception of MSB formerly known as Akta Pengurup Wang 1998. Madam Analisa held the position of Compliance Officer from 2011-2017 and thereafter has been the CEO of Akar Warisan Sdn Bhd. In 2020, she was elected as the Chairman of Southern Region and a member of the MAMSB Council.

Madam Analisa is an active MAMSB member and hold the position as Chairman of Membership Committee, Vice Chairman of IT Committee and Member of Education Committee, Education Task force and 100 days KPI task force. Madam Analisa has graduated with O Levels, A Levels and Diploma in Marketing Studies.

Chairperson of Northern Region

MOHAMED SHERAFATH ALI BIN ABDUL RAHMAN

Managing Director

Sharafath Ali Sdn Bhd

Sharafath Ali Sdn Bhd

View Profile

Chairperson of Northern Region

MOHAMED SHERAFATH ALI BIN ABDUL RAHMAN

Managing Director

Sharafath Ali Sdn Bhd

Sharafath Ali Sdn Bhd

COMING SOON

East Coast Council Representative

AMARUL HANIF BIN HARUN

Managing Director

World Currency Sdn Bhd

World Currency Sdn Bhd

View Profile

East Coast Council Representative

AMARUL HANIF BIN HARUN

Managing Director

World Currency Sdn Bhd

World Currency Sdn Bhd

COMING SOON

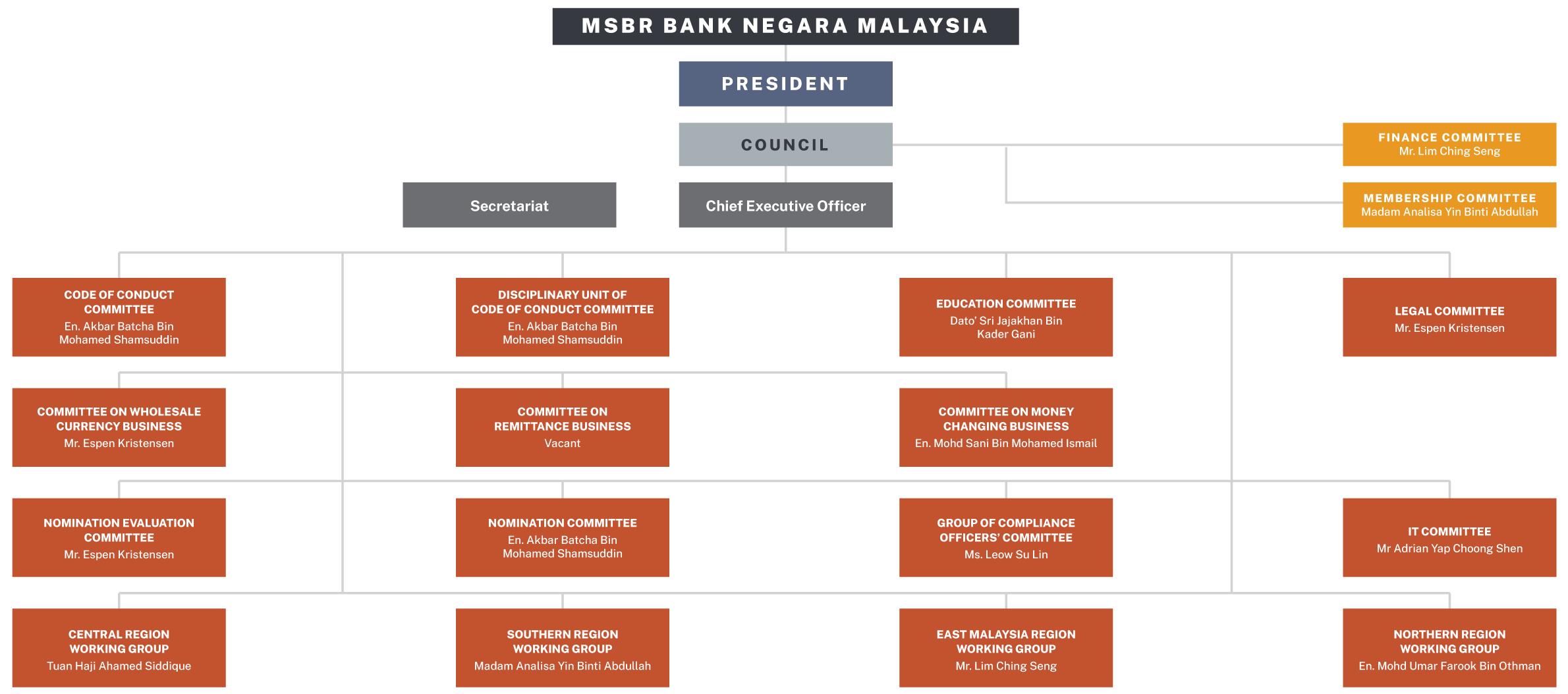

Organisation Structure

-

RAMAN KRISHNANChief Executive Officer

RAMAN KRISHNANChief Executive Officer

Mr. Raman Krishnan was appointed by the Association as Chief Executive Officer (CEO) and commenced his duties on 2nd October 2023.

He joined Bank Negara Malaysia (BNM) in year 1983 as an Internal Auditor. He then was promoted to Branch Manager in Penang from year 2004 to 2008, overseeing the overall operation of the branch. Subsequently, he was given the position as Manager, Currency Management and Operations from 2008 till 2010 and was promoted to Regional Head/ Deputy Director for Johor Bharu branch in year 2011. He later was advanced to Deputy Directors Compliance- Cash Management Department in 2018 until his retirement. He is a qualified and professional banker with a background of 36 years of experience in regulatory, compliance and cash management in his years of service.

Click on image to enlarge

Committees

A committee is elected by the council members in the association to continue the work of the association between general meetings. It is the committee members’ responsibility to make sure that decisions taken at its association are acted on during their year in office. Committees help spread the workload. At its simplest, a committee is simply a group of motivated people who meet regularly to make plans and decision in the scope of their role.

- Class Committee

- Working Committee

- Task Force

CLASS A

Dato' Sri Jajakhan Bin Kader Gani

Jags Money Sdn Bhd

Mr. Espen Kristensen

IME (M) Sdn Bhd

Tuan Haji Ahamed Syed Sidique Bin Abdul Latiff

AlifnMoney Changer Sdn Bhd

Md. Nur E Alam Siddiqui

Placid Express Sdn Bhd

Mr Chinthu Sreenivas

Lulu Money (Malaysia) Sdn Bhd

CLASS B

Iza Izwana Binti Hussian

Onetransfer Remittance Sdn Bhd

Mrs Lugiyem

Mandiri International Remittance Sdn Bhd

Ahmad Ezzanee Azizan Bin Mohd Ali Azizan

Golden K.L Union Sdn Bhd

Soby Kurian

Lotus Group Ent Sdn Bhd

Mohammad Ridzuan Abdul Aziz

Worldremit (Malaysia) Sdn Bhd

Ray Parvish Singh Segaran Thevar

Airwallex (Malaysia) Sdn. Bhd.

CLASS C

Amy Pang Choy Har

Focurek Services Sdn Bhd

Abdul Rahman Bin Achmed

Roz Money Changer Sdn Bhd

Bhurhanuddin

Ipoh

Chua Yee Chun

Inco Licensed Money Changer Sdn Bhd

David Ban Boon Sing

Milirich Sdn Bhd

David Chu Ah Poi

Port Store Sdn Bhd

Jeremy Lim

Foo In Sdn Bhd

Mr Haris Vazeer

Malik Maju Sdn Bhd

Mr. Mohamed Ridzwan Bin Mohamed Salim

Pahlawan Money Changer Sdn Bhd

Madam Analisa Yin Binti Abdullah

Akar Warisan Sdn Bhd

CLASS D

Lee Sze Koon

Ace Money Exchange Sdn Bhd

Dato' Sri Jajakhan Bin Kader Gani

Jags Money Sdn Bhd

Abd Hamid Bin Abdullah

Maxmoney Sdn Bhd

Mr Chinthu Sreenivas

Lulu Money (Malaysia) Sdn Bhd

Chong Hui Yee

E-Globex Sdn Bhd

Rakesh A/L A. Aravindan

Travelex Currency Exchange & Payments (TCEP)

LEGAL COMMITTEE

CHAIRMAN

Mr. Espen Kristensen

IME (M) Sdn Bhd

VICE-CHAIRMAN

Ms. Leow Su Lin

Foo In Sdn Bhd

SECRETARIAT

Mr.Raman Krishnan

MAMSB Secretariat

GROUP OF COMPLIANCE OFFICERS (GOCO) COMMITTEE

CHAIRMAN

Ms. Leow Su Lin

Foo In Sdn Bhd

VICE-CHAIRMAN

TBC

-

SECRETARY

Ms. Chun Yun Xuan

Wang & Co. Money Changer Sdn Bhd

ASST. SECRETARY

Ms. Nurul Ana Shukor

NIUM Sdn Bhd

TREASURER

TBC

-

ASST. TREASURER

Mr. Lim Tze Di (Alex)

Symbolic Business Sdn Bhd

MEMBERS

Mr. Mohamad Azizul Bin Abdul Rahman

Mobile Money International Sdn Bhd

Mr. Gunasekaran S.Raghavan

Akbar Money Changer Sdn Bhd

Ms. Stephanie Sheila Phan Mei Loong

Everrise Money Changer Sdn Bhd

Mr. Mohd Noorhamidi Bin Hishamuddin

TNG Digital Remittance Sdn Bhd

Ms. Ainul Huda Jamil

World Currency Sdn Bhd

EDUCATION COMMITTEE

CHAIRMAN

Mr. Mohamed Ershad Bin Syed Jahabar

S.S.B Interchange Sdn Bhd

SECRETARIAT

Mr. Raman Krishnan

MAMSB Secretariat

MEMBERS

Mr. Indra Raj Giri

GPL Remittance Malaysia Sdn Bhd

Mr. Alex Lim

TML Remittance Centre Sdn Bhd

Ahmad Ezzanee Azizan Bin Mohd Ali Azizan

Golden KL Union Sdn Bhd

Bala Satya

Advisory

Dr. Mohd Fodli bin Hamzah

Mandiri International Remittance Sdn Bhd

Chua Yee Chun

INCO Licensed Money Changer Sdn Bhd

Ms. Leow Su Lin

Foo In Sdn Bhd

FINANCE COMMITTEE

CHAIRMAN

Mdm Siew Yoke Moy

-

MEMBERS

Chua Yee Chun

INCO Licensed Money Changer Sdn Bhd

CODE OF CONDUCT COMMITTEE

CHAIRMAN

Mr. Manimakudom A/L Karuppiah

Suria Muhabbat Sdn Bhd

Secretariat

Mr. Raman Krishnan

MAMSB Secretariat

MEMBERS

Dato’ Haja Maidin Bin Dawood

Halasuria (M) Sdn Bhd

Elina Binti Ahmad

Bank Pertanian Berhad (Agro)

Tn Hj Mohamed Sherafath Ali Bin Abdul Rahman

Sharafath Ali Sdn Bhd

Mr. Indra Raj Giri

GPL Remittance Malaysia Sdn Bhd

Robin Yu-Hao Chu

Port Store Sdn Bhd

Mr. Soby Kurian

Lotus Group Ent.

IT ADVISORY COMMITTEE

CHAIRMAN

Sarveswarren Raja Gopal

T&G Digital Remittance Sdn Bhd

Secretariat

Mr. Raman Krishnan

MAMSB Secretariat

MEMBERS

Mr. Espen Kristensen

IME (M) Sdn Bhd

Dato' Sri Jajakhan Bin Kader Gani (Class A)

Jags Money Sdn Bhd

Adrian Yap Choong Sen)

Money March Sdn Bhd)

Rakesh A/L A. Aravindan)

Travelex Malaysia Sdn Bhd)

Mdm See Yoke Siew)

Adcrew Sdn Bhd)

Mr Manimakudom Karuppiah)

Suria Muhabat Sdn Bhd)

Digital Technical Committee

CHAIRMAN

Mr. Sarveswarren Raja Gopal

TNG Digital Remittance Sdn Bhd

Secretariat

Mr. Raman Krishnan

MAMSB Secretariat

MEMBERS

Mr. Ramesh Chaulagain

IME Sdn Bhd

Mr. Sujai Raman Sundaresan

Lulu Money (Malaysia) Sdn Bhd

Mr. Mohd Zahirul Kadir

NBL Money Transfer Sdn Bhd

Mr. Adrian Yap Choong Shen

Money Match Sdn Bhd

Mr. Mohammad Ridzuan Abdul Aziz

WorldRemit Malaysia

Mr. Lim Paik Wan

Wise Payments Malaysia Sdn Bhd

MPA Technical Committee

CHAIRMAN

Mr. Espen Kristensen

IME (M) Sdn Bhd

VICE-CHAIRMAN

Mr. Mohd Sani Bin Mohamed Ismail

Munawarah Exchange Sdn Bhd

Secretary

Mr. Alex Lim

TML Remittance Center Sdn Bhd

Secretariat

Mr. Raman Krishnan

MAMSB Secretariat

MEMBERS

Mr. Jacob Varughese (Class A)

Lulu Money (Malaysia) Sdn Bhd

Mr. Ramesh Chaulagain (Class A)

IME Sdn Bhd

Mr. Abd Hamid Bin Abdullah (Class A)

Max Money Sdn Bhd

Mr. Sarveswarren Raja Gopal (Class B)

TNG Digital Remittance Sdn Bhd

Mr. Sheikh Akhter Uddin Ahmed (Class B)

NBL Money Transfer Sdn Bhd

Dato' Sri Jajakhan Bin Kader Gani (Class A)

Jadeline Exchange Sdn Bhd

Mr. Manimakudom A/L Karuppiah (Class C)

Suria Muhabat Sdn Bhd

Tuan Haji Ahamed Syed Sidique Bin Abdul Latiff (Class A)

Alif Money Changer Sdn Bhd

Mr. Adrian Yap Choong Shen (Digital Services Licensee)

Money Match Sdn Bhd

Ms. Leow Su Lin (GOCO Chairman)

Foo In Sdn Bhd

Money Changing Business Committee

CHAIRMAN

Mr. Mohd Sani Bin Mohamed Ismail

Munawarah Exchange Sdn Bhd

VICE-CHAIRMAN

Mr. Mohamed Arshad Bin Datuk Hj. Mohamad Iqbal Ganey

Benua Kapital Sdn Bhd

MEMBERS

Madam Analisa Yin Binti Abdullah

Akar Warisan Sdn Bhd

Umar Farook Bin Othuman

Triple Trillion Sdn Bhd

Tuan Haji Ahamed Syed Sidique Bin Abdul Latiff

Alif Money Changer Sdn Bhd

Mr. Nagapan a/l Nagarajan

Spectrum Forex Sdn Bhd

Mr. Keyasudeen Bin Mohd Furuskhan

KMA Trading Sdn Bhd

Mr. Lu Chen Kiong

Traveller’s Money Changer Sdn Bhd

Ms. Leow Su Lin

Foo In Sdn Bhd

Mr. Mohamed Ridzwan Bin Mohamed Salim

Pahlawan Money Changer Sdn Bhd

Wholesale Currency Business Committee

CHAIRMAN

Mr. Rakesh Aravind

Travelex Malaysia Sdn Bhd

MEMBERS

Dato Sri Jajakhan Bin Kader Gani

Jags Money Sdn Bhd

Mr Chong Hui Yee

E-Globax Sdn Bhd

Mr Chinthu Sreenivas

Lulu Money (M) Sdn Bhd

Mr Reynels Lee

Ace Money Exchang

MAMSB Task Force Combat

CHAIRMAN

Mr. Espen Kristensen

IME (M) Sdn Bhd

Tuan Haji Mohamed Burhan Bin Mohd Alahudin

Permata Sdn Bhd

Mr Foong Chee Seong (William)

Durian Burung Enterprise Sdn Bhd

Tuan Haji Ahamed Syed Sidique Bin Abdul Latiff

Alif Money Changer Sdn Bhd

Mr Ayaz Khan

Apexchange Sdn Bhd

Mr Haris Vazeer

Malik Maju Sdn Bhd

Madam Analisa Yin

Akar Warisan Sdn Bhd

Mr Alex Lim

TML Remittance Centre Sdn Bhd

Ms Wong Siew Hong

Yewon Sdn Bhd

Ms Tan Lian Ping

Segi Bintang Sdn Bhd

Ms Hanilam Binti Matali

Segi Ganjaran Sdn Bhd

MAMSB Strategic Blueprint Task Force

CHAIRMAN

Mr. Mohamed Ershad Bin Syed Jahabar

S.S.B Interchange Sdn Bhd

Mr Manimakudom Karuppiah

Suria Muhabat Sdn Bhd

Mr. Adrian Yap Choong Shen (Digital Services Licensee)

Money Match Sdn Bhd

Ms. Leow Su Lin (GOCO Chairman)

Foo In Sdn Bhd

Mr. Sarveswarren Raja Gopal (Class B)

TNG Digital Remittance Sdn Bhd

Mr. Ramesh Chaulagain

IME Sdn Bhd

Ms Noorzliana Binti Ahmad

Merchantrade Asia Sdn Bhd

Mr Rajendar Dhorkay

Instarem Sdn Bhd

Mr Akhbar Batcha Bin Mohamed Shamsuddin

Akbar Money Changer Sdn Bhd

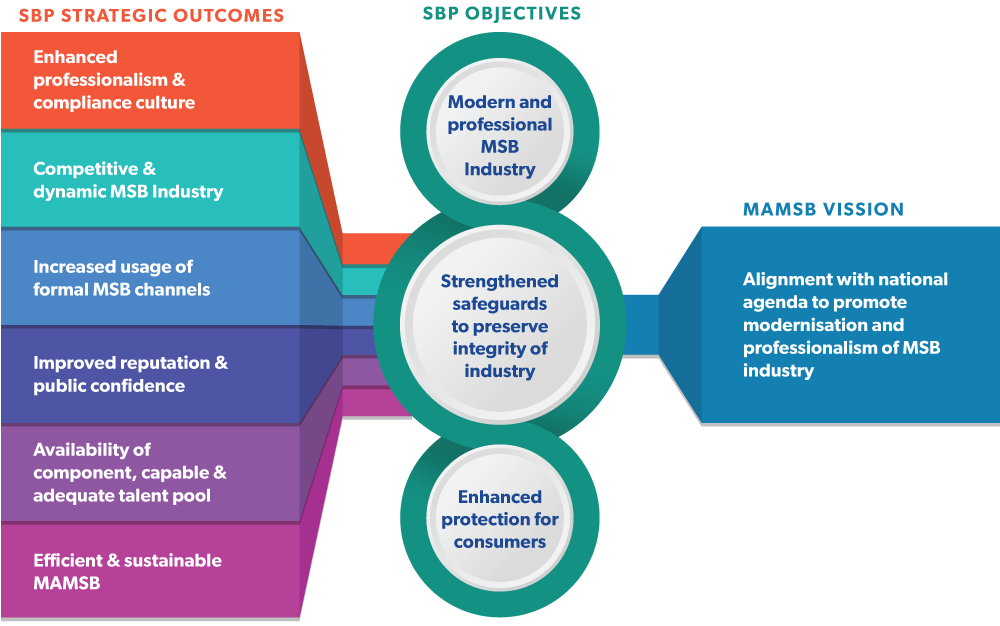

Strategic Blueprint

The Taskforce on the Money Services Business Strategic Blueprint was set up by the Association in January 2021 pursuant to the Money Services Business Regulator’s (MSBR) aspiration for the Association to continue its efforts to modernise and transform the MSB industry into a progressive and professional sector for the next 5 years (2022-2026). The inaugural strategic blueprint (SBP) that was crafted in 2015 had successfully identified the 3-fold objectives for the development of the SBP and derived 6 SBP Strategic Outcomes that collectively aimed at meeting the Association’s Vision.